Guide to the council budget

Nationally, local authorities continue to face significant financial pressures: increasing costs and demand for services, challenges in recruitment and uncertainty over future funding arrangements, and funding allocations, place the financial resilience of all local authorities under strain.

Transformation

The council continues to invest in transformation activity to support improvement of its services: of which the improvement of children's services remains a key corporate priority.

Transformation efficiencies and savings will be achieved through improvements to systems, processes and technology; using digital solutions and technology to improve the customer offer and maximise opportunities to work with communities and partners alongside maximising income through service cost recovery.

Council Tax

The Ministry of Housing, Communities and Local Government (MHCLG) confirmed in a statement on 29 November 2024, that while it is for local authorities to decide at what level they set their Council Tax, the previous government's policy of a 3% core Council Tax cap, and an additional 2% for local authorities with adult social care responsibilities, in line with OBR forecasting, would be maintained.

Our priorities

The council budget ensures that corporate and service plans are developed in the context of available resources and that those resources are allocated in line with corporate priorities set out in the Council Plan, "Delivering the best for Herefordshire in everything we do."

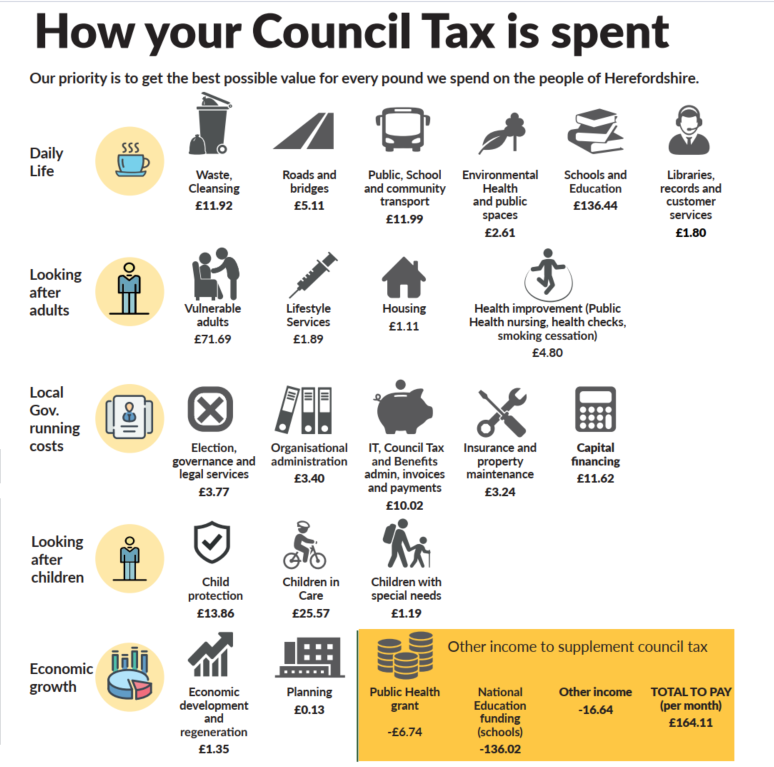

How your Council Tax is spent each month

Graphic explanation

Our priority is to get the best possible value for every pound we spend on the people of Herefordshire.

The graphic shows how your monthly Council Tax is spent on council services:

Daily life

- Waste, cleansing £11.92

- Roads and bridges £5.11

- Public, school and community transport £11.99

- Environmental health and public spaces £2.61

- Schools and education £136.44

- Libraries, records and customer services £1.80

Looking after adults

- Vulnerable adults £71.69

- Lifestyle services £1.89

- Housing £1.11

- Health improvement (public health nursing, health checks, smoking cessation) £4.80

Local government running costs

- Election, governance and legal services £3.77

- Organisational administration £3.40

- IT, Council Tax and benefits administration, invoices and payments £10.02

- Insurance and property maintenance £3.24

- Capital financing £11.62

Looking after children

- Child protection £13.86

- Children in care £25.57

- Children with special needs £1.19

Economic growth

- Economic development and regeneration £1.35

- Planning £0.13

Other income to supplement Council Tax

- Public health grant -£6.74

- National education funding (schools) -£136.02

- Other income -£16.64

Total Council Tax to pay per month £164.11